Disclosure: This material is reader-supported, which suggests if you click a few of our links that we might make a commission.

Merchant services exist to assist services procedure charge card payments. You may understand them by the name ““ charge card processors.”

.

Regardless of what you call them, it ’ s essential to select the ideal merchant service for your particular organization if you wish to take payments from consumers.

.

I ’ ve evaluated the leading 6 merchant services readily available today. These are all shown, popular items with sensible charges.

They all do things a little in a different way, nevertheless, and serve specific kinds of organizations much better than others.

Keep checking out to discover the one that’’ s going to fit with your scenario. I’’ ll take an extensive take a look at each of the 6 finest merchant services, and conclude by strolling you through the significant requirements you require to think about as you assess your choices.

.# 1. Square Review —– The Best for Transparent Pricing/Fees

Pros:

.No month-to-month feeTransparent processingFree card readerGreat included functions.

Cons:

.No ACH payment processingHigher charges than preferred.

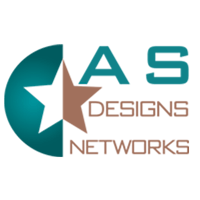

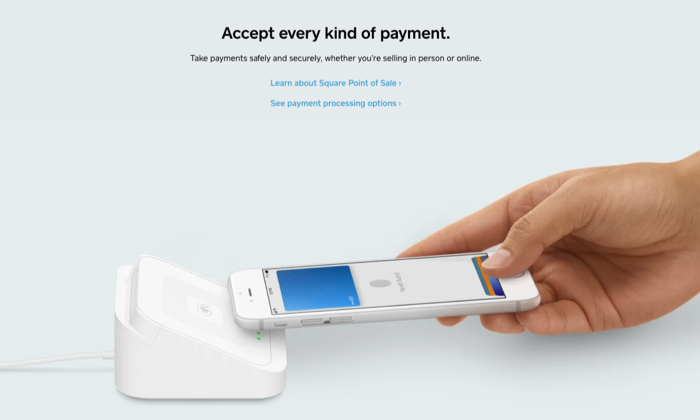

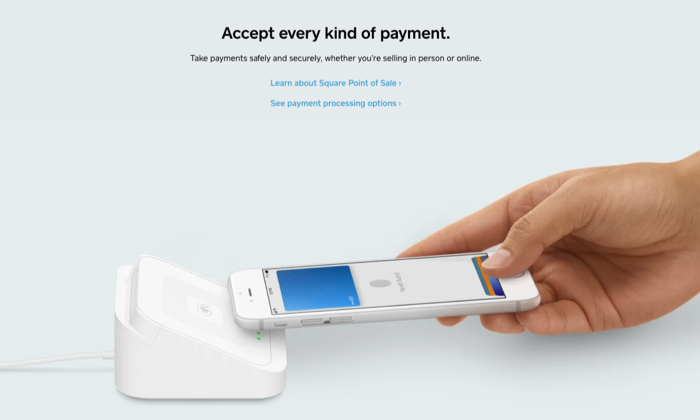

Square is popular for its charge card processing and POS systems, however it provides a lot more. It hosts functions such as the ““ Card on File ” function, permitting users to save consumer card info that works excellent for repeat clients attempting to collect commitment points and benefits of that nature.

The processor likewise doesn’’ t have a regular monthly charge, and while Square ’ s functions may not be as advanced as a few of the other payment processors we ’ re speaking about, for a POS without a month-to-month cost, you can’’ t beat the worth.

.

You can accept payments in-person and online, though the deal expenses differ. For in-person sales, anticipate to pay 2.6% and $0.10 per deal. For online deals, it’’ ll expense you 2.9 %and$ 0.30 per deal. There are other circumstances, such as:

.Virtual terminal transactionsCard-on-file transactionsAnd card-not-present deals.

These will cost 3.5% and $0.15 per deal.

If you have countless deals each month, you can absolutely discover something less expensive than square.

But for a small company, the absence of month-to-month charges and cost openness makes it simpler to budget plan than a few of the other merchant services. Learn more.

.# 2. Payment Depot Review —– The Best for Established Businesses

Pros:

.No agreement processingCompetitive ratesEasy to incorporate online.

Cons:

.Best for high-volume businessApplication procedure.

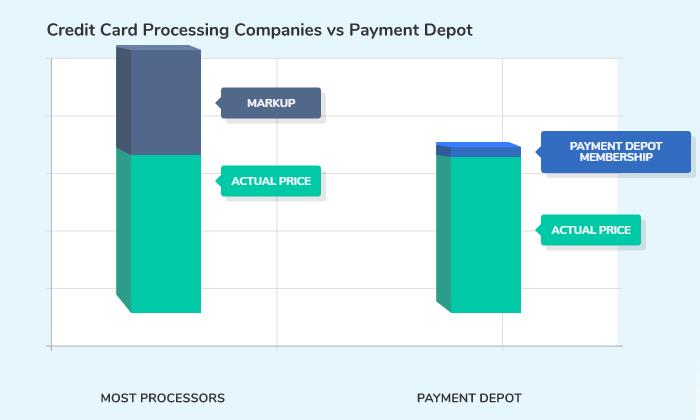

Payment Depot utilizes a subscription rates design, which can conserve recognized organizations a great deal of cash.

New companies that aren’’ t doing so much volume won ’ t see the advantage( and might really end up with greater charges than they would with other services), however if you are currently managing a great deal of deals, Payment Depot can be an excellent option.

Unlike other business, the processing charges with Payment Depot’’ s subscription rates stay foreseeable and constant no matter just how much company you do.

Because Payment Depot isn’’ t of passing off charge card charges to the consumer at an increased markup, you can end up conserving a lots of cash. The more deals you procedure, the more you conserve with the subscription prices.

Payment Depot accepts all significant cards and contactless Apple Pay and Google Pay. You get next-day financing and combination with leading POS systems in addition to ecommerce platforms such as:

.ShopifyRevelQuickBooksPrestaShopBigComemrceWooCommerce.

I put on’’ t believe this is among the very best merchant services for small companies since of how they structure their rates. The deal charges decrease as you pay a greater month-to-month cost, and they relatively require you to increase your strategy since of rigorous processing limitations.

Here’’ s a breakdown of their prices:

Basic Plan

.Charge: $49Transaction Fee: $0.15 Monthly Limit: $25,000.

Popular Plan

.Charge: $79Transaction Fee: $0.10 Monthly Limit: $75,000.

Premier

.Cost: $99Transaction Fee: $0.07 Monthly Limit: $150,000.

Unlimited

.Cost: $199Transaction Fee: $0.05 Monthly Limit: Unlimited.

So, as you can see –– if you’’ re doing high volume, it would make one of the most sense to update to the most costly prepare for the most affordable deal costs.

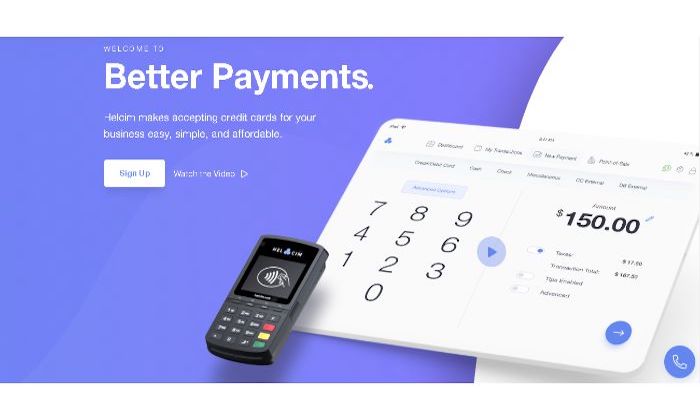

.# 3. Helcim Review —– The Best for Small Business

Pros:

.Restricted feesFees based upon volumeFree online shop software application.

Cons:

.Minimal combinations$ 199 for the card reader.

If you’’ re a small company owner, Helcim may attract you. With this service, you’’ re able to process credit and debit cards online and personally. You can likewise do a few of the following: Set up repeating payments and send out billings.

With a Helcim card reader, you can accept all significant cards, consisting of Amex plus Google Pay, Apple Pay, and JCB.

Helcim does not have any agreements or cancellation charges, and they charge $0 in month-to-month costs.

Overall, Helcim is budget friendly however far more for in-person payments than they are online. Here’’ s a fast breakdown of their prices structure, which is based upon just how much company you do monthly:

Monthly Volume: $0 –– $25,000

.In-Person: 0.3% + 8 cents (+ interchange) Online: 0.5% + 25 cents (+ interchange).

Monthly Volume: $25,001 –– $50,000

.In-Person: 0.25% + 7 cents (+ interchange) Online: 0.45% + 20 cents (+ interchange).

Monthly Volume: $50,001 –– $100,000

.In-Person: 0.2% + 7 cents (+ interchange) Online: 0.4% + 20 cents (+ interchange).

Monthly Volume: $100,001 –– $250,000

.In-Person: 0.18% + 6 cents (+ interchange) Online: 0.35% + 15 cents (+ interchange).

Helcim provides good functions for those of you aiming to incorporate this payment entrance into your online shop. You can include a checkout to your website for invoicing and consumer registration while likewise accepting repeating memberships.

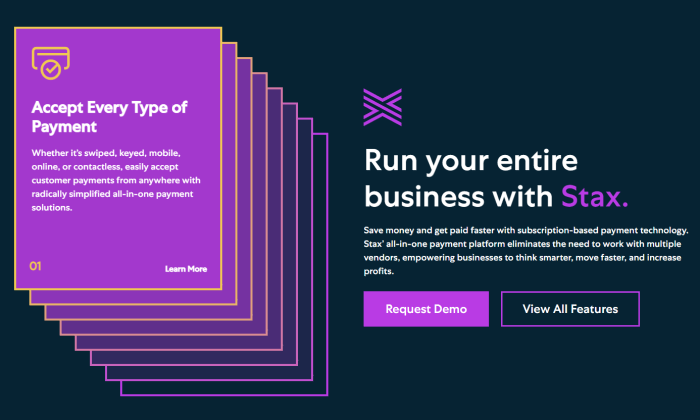

.# 4. Stax by Fattmerchant Review —– The Best for Subscription-Based Businesses

Pros:

.Basic pricingOmni softwareA strong option for membership companies.

Cons:

.Greater month-to-month feesTransaction charges are fairly basic.

Stax by Fattmerchant is established a lot like a lot of the payment processors. As you increase your regular monthly charge, your deal charges decrease. They provide Omni, which is where you’’ ll do your invoicing, payments, and reporting. The service is exceptionally easy to use, terrific for novices, and it comes consisted of with your month-to-month charge.

While Stax is an excellent option for budget-conscious entrepreneur, it’’ s likewise a fantastic alternative for subscription-based services. If’you ’ re offering regular monthly training plans, company services, or therapy, you’’ ll gain from’Stax ’ s structure.

.

The processor accepts all significant cards, consisting of ACH, invoicing, Text2Pay, and more. Very same day financing is offered, and you get a complimentary iOS and Android POS app and Bluetooth card readers that you can utilize on the go.

Stax has incredibly competitive rates that are simple to anticipate.

For services processing as much as $5 million every year:

.Beginning at $99/monthCard-Present Fee: $0.08 + InterchangeCard-Not-Present: $0.15 + InterchangeACH Processing Fee: 1% of deal, as much as $10.

If your companies processes more than $5 million yearly, you’’ ll need to contact us for a customized quote. The business likewise uses merchant services for SaaS Platforms, which might be your best option if you’’ re in the membership service video game.

Stax has a greater regular monthly cost than some others, however the business states that is how they keep their deal charges down. Learn more.

.# 5. Flagship Merchant Services Review —– The Best for Great Customer Service

Pros:

.Committed account managerFree account setupFree card terminal (with charges).

Cons:

.Complicated ownershipLittle info relating to rate.

Flagship Merchant Services cut the tape in 2001 and was obtained by iPayment in 2012. Now, they mainly resell iPayment, so keep that in mind.

This business was among the very first to use totally free account setup with no application or charges and genuine month-to-month agreements. They run 10s of countless merchants, and they have a strong credibility.

Since they’’ re not a direct processor, the majority of their merchant accounts are established through iPayment. iPayment utilizes First Data as their processor, and it can get complicated attempting to determine who is processing what through what service.

For merchants, Flagship does use a totally free charge card terminal, however you’’ re accountable for paying account costs and insurance coverage on that terminal to keep it up and running.

For ecommerce, they #aaaaa either use href=” https://www.authorize.net/” target=” _ blank” rel=” noreferrer noopener”> Authorize.net for processing and combination of an online cart onto your website.

One thing that was a little aggravating about Flagship is looking for details on their rates. If you go to their site , you’’ ll see that you require to submit a type to get any information about what they charge.

.

I ’d like to see more openness, however you might wind up with a more catered package with this technique.

.When you acquire an entrance; they act as account supervisors, #ppppp> My preferred function is that you get a single line of contact with the business. If you ever have an issue, you call that particular individual, and this isn’’ t a function I ’ ve ever seen with any other merchant service.

. # 6. Stripe Review– The Best for Online Payment Processing

Pros:

. Incredibly customizableReasonable pricingGreat option for online companies.

Cons:

. Complex setupMay need designers.

If your company runs totally online, Stripe is your finest option. It ’ s made particularly for ecommerce and web company, and lots of start-ups and Fortune 500 business trust Stripe.

.

The business uses advanced software application and APIs that permit online shopkeeper to tailor their checkout experience. You can utilize the pre-built combinations to link a Stripe checkout immediately and after that tailor it as you go along.

.

That ’ s among the primary reasons that I like Stripe; it ’ s a payment processor that grows with you and permits you to alter it as your company requires modification.

.

With all of these functions and moving parts comes problems. It ’ s not the simplest to establish, and if you intend on making use of the lots of advantages of Stripe, you ’ ll most likely require a designer to manage it for you.

.

Stripe uses a “ pay as you go ” method– there ’ s no regular monthly charge and deal costs are transparent throughout the board.

. Online: 2.9% and “$ 0.30In-Person: 2.7% and$ 0.05 International:’Add 1 %per transactionACH Direct: 0.8 %maxed at $5.00 per transactionACH Credit : $1.00 per deal.

You can utilize all significant credit and debit cards plus ACH, WeChat Pay, Apple Pay, Google Pay, and a lot more. Anticipate to wait 2 service days for deposits or pay a one percent charge to get instantaneous deposits.

.

Stripe incorporates with WordPress, Magento, Squarespace, 3DCart, Zoho, Big Cartel, and more.

. How to Choose The Best Merchant Services For You.

Before we enter the evaluations, let ’ s speak about how to identify what makes a great merchant service.

.

I ’ ve broken this down into 3 significant locations:

. Processing rates/monthly feesServicesType of merchant services account.

Let ’ s go through each of these requirements, one by one.

. Processing Rates/Monthly Fees.

It ’ s everything about the cash, and charge card processing isnot as easy as you believe. You need to weigh the benefits and drawbacks with each service; otherwise, you can wind up paying method morethan you prepared.

.

We require to look at the processing rates. With every merchant service, you pay a little charge each time a deal is processed. It ’ s normally in between 1 to 3 %.

You ’ ll likewise pay month-to-month charges, which differ depending upon the service you select.

.

To get a lower processing rate, you typically need to pay a greaterregular monthly charge’.

.

So, if you ’ re processing a lots of payments, a merchant service with a high regular monthly charge and low processing rates can be an excellent alternative.

On the other’side, if you ’ re not processing a great deal of payments, having greater procedure rates won ’ t hurt you as much as a high month-to-month charge would.

.

There are likewise the rates that various charge card like Visa and Mastercard charge. Merchant services like Toast let you select in between flat-rate and interchange processing rates .

.

With flat-rate, you pay a set quantity for processing every month. With interchange, you pay whatever Visa or Mastercard charges plus a little cost to Toast.

.

Flat-rate processing is a foreseeable service that works well for companies that wish to prevent huge modifications in their rates. That stated, interchange prices is usually more budget friendly.

.Providers.

You wish to take a look at what the payment processor uses in addition to charge card processing. Do they provide complimentary POS systems, hardware, mobile payments, combinations, etc?

Some merchant services even provide consulting, consumer commitment functions, and invoicing tools.

.

Sometimes the “ additional advantages ” you obtain from a merchant provider can exceed a few of the negatives.

. The Type of Merchant Service Account.

There are 2 main kinds of accounts, one is an aggregator (or intermediary), and one is an ISO( or independent sales company).Let ’ s compare the 2 and see why it ’ s essential to comprehend the distinction.

.

Aggregators

.

These are intermediaries operating in between the bank and the organization, using a simple payment processing service’for companies. Square is an example of this, and whilethey make it simpler, they generally have greater charges and deal expenses.

.

ISOs

.

Payment Depot is an example of an ISO, and while they normally have a more rigorous approval policy, they use lower rates and easy to use software application compared to a direct processor.

. Combination.

How well will your existing systems incorporate with your brand-new merchant service?

.

Whether your are offering online or personally, the item you select need to match your existing procedure or perhaps improve it.

Stripe provides a vast array of combinations for popular ecommerce platforms , that makes it an excellent option foronline shops. It likewise incorporates with the finest e-mail autoresponders like MailChimp and GetResponse.

.

If you are currently utilizing these tools, Stripe combinations will make it much easier to ready up and remain arranged.

.

You shouldn ’ t need to revamp your day-to-day workflow to accommodate a brand-new merchant service, so discover one that has the combinations to plug right into your organization.

. Summary.

By this point, you need to understand which of these merchant services is ideal for you. They all have their cons and pros, and you need to select according to the kind of organization you own.

.

Let ’ s take a glance back at my leading choices:

. Square — Best for transparent pricing/fees Payment Depot — Best for recognized organizations Helcim — Best for small company Stax by Fattmerchant — Best for subscription-based Businesses Flagship Merchant Services — Best for fantastic customer care Stripe —– Best for online payment processing.

If your service is currently doing a great deal of volume, I suggest checking out Payment Depot — .

.

Square is a total strong option for all organizations, however the deal charges are a bit high, and scalability is doing not have.

.

I ’ m likewise a huge fan of Helcim since they enable you to grow with your processor by increasing the regular monthly payment as your volume requires boost.

.

Regardless of which option you make, keep the essential consider mind and pick thoroughly, so you wear ’ t regret your choice down the roadway.

Read more: feedproxy.google.com